Burgers Buck Restaurant-Count Decline

The number of U.S. restaurants is shrinking. But quick-service burger restaurants, both chains and independents, didn’t get that memo and continue to grow.

Research released Monday by Chicago-based The NPD Group finds that the total number of U.S. restaurants declined by 6,483 or 1.1% between the fall of 2010 and the fall of 2011. The drop was primarily due to independent-restaurant closings.

However, additional data compiled by NPD Group for BurgerBusiness.com, shows that the QSR Burger category eked out a small gain during that period. Even independents—which suffered a loss of 6,863 restaurants between 2010 and 2011—showed a slight increase in the QSR Burger category.

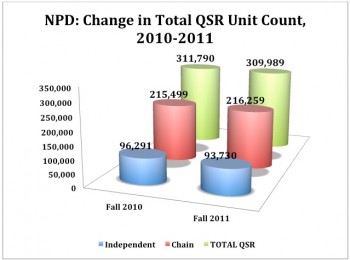

As shown in the chart at left, independent QSR Burger restaurants increased by units, according to NPD’s Fall 2011 ReCount, a census of commercial restaurant locations in the United States that is compiled in the spring and fall of each year. The number of QSR Burger chain restaurants increased by 275 or 0.6% between 2010 and 2011. The overall QSR Burger category was up 0.7%.

That compares with a 1% decline overall for all QSR restaurants (all menu types). That total is the result of a slight (+0.4%) increase in the number of QSR chain restaurants to 216,259, and a 2.7% decrease (to 216,259) in the number of QSR independents in 2011 (see chart at right).

Source: NPD Group; BurgerBusiness.com graphic

The number of full-service restaurants (including casual dining, mid-scale and fine dining), decreased by 4,682 units or 2%, according to the ReCount data. In total, chain restaurants of all types posted a net gain of 380 units in 2011, while independents lost 6,863 units.

That the number of independent QSR Burger restaurants increased at all is testimony to the strength of the burger category. Independent restaurants have been hit especially hard by the economic downturn and slow recovery. Data released by NPD in February 2012 showed the number of restaurant visits declined from 62.7 million in 2008 to 60.6 million in 2011. Independents account for a whopping 87% of that loss.

That’s 2 million fewer diners at independent restaurants in 2011 than in 2008. Independents’ share of all restaurant customer traffic fell to 27% in 2011 from 28% in 2010.

Since 2009, the number of independent restaurants in the U.S. has declined by 7,158, NPD’s ReCount finds. How many restaurants lost in two years is that? Consider that there were a total of 6,594 Wendy’s operating at the first of this year.

“Independent restaurant operators have neither money nor resources that the chains have,” Bonnie Riggs, NPD analyst said in a release in February. “They lacked the marketing power to drive traffic and the monetary buffer to get through difficult times the past several years.”

But apparently QSR burger operators are just a little more savvy and resilient than that.